Using one word, how would you describe the Medicare health insurance landscape in the U.S.? Dizzying? Maybe. Overwhelming? Probably. Confusing? Definitely.

You’re not alone. From Medicare Advantage plans to Medicare Supplement plans to standalone Part D plans for prescription drug coverage, there are 24,000 different plans available nationwide for 2022. Even if you focus on Medicare Advantage plans specifically and zoom in using your ZIP code and demographic information, you’re likely still scrolling through a list of more than 30 plans for which you’re eligible.

While the sheer quantity of options and their distinctions is enough to trigger decision fatigue in the clearest of minds, it’s not the only reason navigating the Wild West of Medicare Advantage enrollment is such a daunting task. Third-party marketing, direct mailers and telemarketer calls frequently and aggressively target those eligible for Medicare, promoting potentially misleading information that can leave seniors feeling frazzled as they attempt to make the best health care decisions for themselves.

It’s time to quiet that chaos.

What You Really Need to Know About Medicare Advantage for 2022

When a U.S. adult reaches age 65, they have two main Medicare coverage options. They can enroll in Original Medicare, which includes hospital care (Part A) and physician care (Part B) provided by the federal government, or they can enroll in a Medicare Advantage plan, which is coverage offered by a private insurance provider that includes hospital care, physician care, prescription drug coverage and more. People who choose Original Medicare can also add to their coverage with Medicare Supplement, or Medigap, plans. Medicare Part D, which covers prescription drugs, is one of the most commonly used Medigap plans.

In this piece, we focus primarily on Medicare Advantage, as this marketplace with numerous private insurance providers is where most confusion arises.

The Number of People Enrolling in Medicare Advantage Is Increasing

About 54 million older U.S. adults use Medicare in some form for their health insurance coverage. More specifically, Medicare Advantage enrollment has been on the rise for the past decade. About 11.1 million people were enrolled in Medicare Advantage plans in 2010, and that number more than doubled by 2020 when 24.1 million people enrolled, representing 39% of all Medicare beneficiaries.

About 70% to 75% of older adults choose health insurance coverage beyond the scope of Original Medicare (Parts A and B), according to Ari Parker, a lead advisor at Chapter, an independent Medicare advisor organization. “There’s Medicare Advantage, which has prescriptions bundled in, and then there’s Medicare Supplement, which is also known as Medigap,” he explains. Of the remaining 25% to 30% of eligible seniors, many receive additional coverage via other programs. “They have some type of additional coverage administered through the government like [Veterans Affairs] VA benefits or Tricare if they’re military veterans. It might be through a retiree plan as well,” says Parker.

In short, most eligible seniors find it necessary to get supplemental coverage beyond Original Medicare, many of which opt for Medicare Advantage plans. Meanwhile, the Medicare system as a whole is supporting more seniors than ever before, due to more older adults living longer as the next generation achieves eligibility. As this significant growth continues, we can expect to see the costs associated with maintaining such a massive infrastructure increase as well, says Dave Rich, founder and CEO of Florida-based insurance technology firm Ensurem.

“In less than a decade, we’ll be adding 17 million people into Medicare—that’s a lot of folks,” says Rich. “Costs will continue to rise because the 85+ population is expanding greatly and we’ll have higher levels of chronic conditions. You have to think about all the claims costs and the increases in those claims costs over time. Chronic conditions are very expensive.”

For example, diabetes is the most expensive chronic condition in the U.S., and 61% of diabetes costs come from care for people age 65 or older, which is mainly paid by Medicare.

Plans Are Changing—Just Like They Do Every Year

Third-party marketing often creates a sense of urgency for seniors to change their current Medicare plan by highlighting all the ways plans changed from 2021 to 2022. While this fluctuation is very much real, it’s definitely not something to panic about.

“Plans change every year,” says Parker. That’s why everyone should confirm their coverage details on an annual basis. “Even if you’re perfectly happy with your plan, it might not be the same plan for the next year. In fact, it’s usually not. Typically, there’s variation,” he says.

“Generally, it’s always important to review your plan because the drug formulary (the list of prescription drugs covered by the plan) changes each year,” adds Parker. “Also, your medications are changing. If you’ve had a medication change, then the plan you’ve had might not cover it in the way you would have expected.”

Rich confirms that more people changed their Medicare coverage in 2021 compared to previous years, and he and his team have a hunch as to why. “What we’re finding is people are more accustomed to shopping—they have another year of experience under their belt in looking at the different plans out there,” he says. “I also think the [COVID-19] pandemic has put their health care front and center. More than anything, [third party marketing] creates this churning effect. They feel like, ‘Wow, it’s 2022, I have to change because there are all new plans.’ But the truth is plans change every single year.”

However, there are some larger trends worth noting. Many plans for 2022 have a greater emphasis on telehealth, which both Parker and Rich expect is related to the pandemic and more people feeling comfortable with seeing their doctors over a video call. “In fact, many Medicare Advantage plans [for 2022] offer $0 telehealth visits,” says Parker.

Another important change is the way in which some plans are pricing insulin for older adults in need of diabetes management. “Many plans have insulin at a much lower cost in 2022 than in 2021, so if you have diabetes, it’s very important to review your plan because you might find one that offers far more savings for your medications,” says Parker.

Costs Are Fluctuating

You cannot consider a plan’s changes in coverage without assessing how its costs are changing as well. Let’s stick with the example of reduced insulin prices for seniors with diabetes. “If these Medicare Advantage plans are now covering more of the costs of insulin and the government hasn’t increased their reimbursement of those plans, what’s going to happen?” asks Rich. “There’s either going to be a premium increase or there’s going to be a benefits reduction.” The cost-benefit scale ultimately has to balance.

“There’s no free lunch out there,” says Rich. “They’re all for-profit plans [in Medicare Advantage], so it sounds great, but there’s going to be a give-up somewhere.”

While premiums, deductibles, copays and out-of-pocket maximums for Medicare Advantage plans run the gamut, every senior with Medicare Advantage coverage is required to pay the Medicare Part B premium (part of Original Medicare) in addition to their private plan’s premium. While the Centers for Medicare and Medicaid Services (CMS) has yet to release the 2022 Medicare Part B premium rates, these costs have increased gradually over the past decade.

COVID-19, the Rise of Telehealth and the Deferral of Treatment

It’s no surprise that private insurance companies offering Medicare Advantage plans for 2022 are focusing more closely on telehealth-related benefits. As we near the close of our second year navigating the COVID-19 pandemic, it’s clear how many people—especially older adults considered more vulnerable to the virus—avoided going to the doctor to reduce the risks associated with leaving home altogether.

“COVID-19 has reduced utilization,” says Rich, referring to the extent to which seniors are—or aren’t—using their various plan benefits. “UnitedHealthcare had to pull three of their plans [for 2022] because they weren’t spending 85% of the premium [the plans brought in]. Regardless of whether it’s coming from the government or the beneficiary, of that total premium, it’s required [by law] that 85% go out in benefits. But because of COVID, seniors aren’t going to the doctor,” explains Rich.

Clearly, pandemic-related behaviors impact the landscape of plans today, but they are also likely to place additional strain on the Medicare system in the future. “If seniors aren’t going to the doctor now, what you get is potential pent-up morbidity (the cost for insurance providers) in Medicare,” says Rich. “When they start going again, they might have chronic conditions that they didn’t take care of earlier, so morbidity could go up in the coming years. We don’t know that for sure, but that’s what we’re thinking might happen.”

Should this projection ring true, the compounded cost increases for insurance companies would likely trickle down, creating higher premiums for seniors in need of care.

The Most Important Elements of Medicare Advantage Coverage

Now that you have a clear grasp of the key forces impacting Medicare Advantage plan coverage and pricing for 2022, let’s dig into exactly which plan details should be prioritized when looking at your current options.

“We often get caught up in the frills and the glitter, but the substantive parts of a plan are the hospital network, the physician network and the prescription drug formularies,” says Rich. “That’s what you should make your selection on because that’s where the morbidity, or the costs of claims, is highest. That’s where you want to make sure you’re covered.”

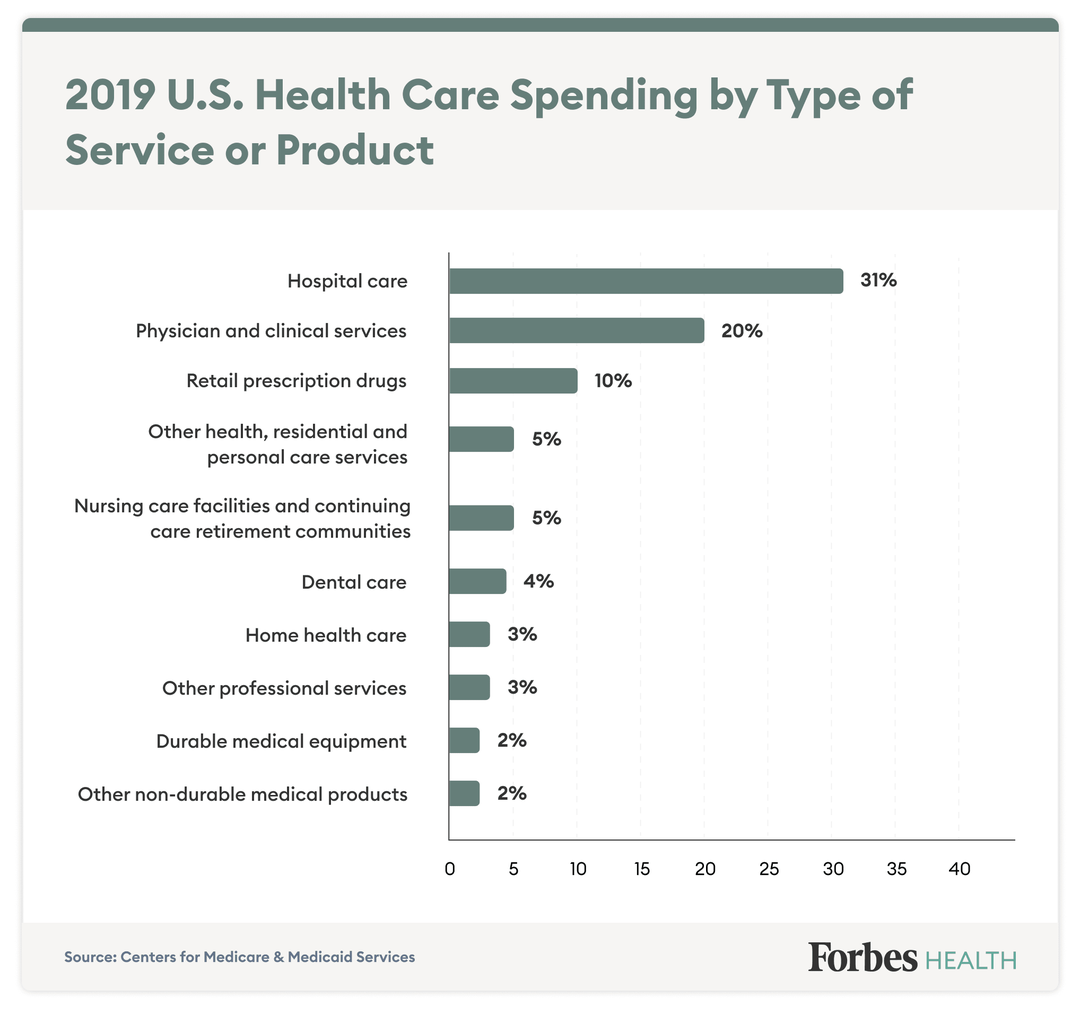

In fact, hospital care, physician care and prescription drugs collectively accounted for more than 60% of U.S. national health expenditures in 2019. If the majority of resources are invested in these areas, it’s only logical to consider how robust that coverage is and how much it could support you over the course of a year.

Once you’ve evaluated the big three areas, consider the less risky benefits, advises Rich. “For seniors, dental and vision coverage is very important, so I would look at those and the networks of those plans,” he says. “After that, look at transportation and meal benefits for outpatient surgery, as well as over-the-counter benefits. Some have hearing aid benefits, too, but I put things like that in a third tier because, in terms of cost, it’s just so much lower.”

Why No Single Plan Is the “Best” Plan

Even with this guidance, it’s virtually impossible for anyone to identify one plan as the absolute best in the bunch across the board, according to both Parker and Rich. It comes down to your specific needs and how well a plan can balance them.

“And it’s really not until the end of this annual enrollment period that we will have a good handle on the changes in premiums, deductibles and benefits and whether the plans are better or worse than they were in 2021,” adds Rich.

With that said, it’s certainly possible to find a plan right now that meets the majority of your coverage needs by shopping the marketplace.

A Step-by-Step Guide to Shopping for Medicare Advantage Coverage

Regardless of whether you’re looking for fresh insight during the 2022 annual enrollment period (which runs from Oct. 15, 2021, to Dec. 7, 2021) or preparing to turn 65 and exploring Medicare Advantage plans for the first time, Rich recommends the following shopping process to keep things clear, simple and—with a little luck—the opposite of overwhelming.

1. Start With CMS

Get your bearings by going to the original source itself—the Centers for Medicare and Medicaid Services. It provides a plethora of helpful explainers on its website, and it mails a Medicare guide to most seniors every year. Start there.

2. Search the Web

Use a website like Medicare.gov and its plan comparison search tool to get a feel for how many plans are available to you in your county, as well as how they vary in both price and coverage. (Both Chapter and Ensurem offer search tools as well.) Forbes Health hosts an abundance of helpful information as well, explaining the differences between types of plans, what each type of plan covers and the best insurance providers to consider first as you begin your search.

3. Search by Hospital

Once you’re looking at the list of plans for which you’re eligible, enter your preferred hospital network information to further narrow the list to only plans that consider your hospital in network.

4. Search by Physician(s)

Just like you did with hospital details, enter your preferred physician(s) to refine the list to only plans accepted by the doctors with whom you trust and want to maintain a relationship.

5. Search by Prescription Drug(s)

Next, enter the prescription drug(s)—and doses—you currently take to see which drug formularies will give you the most cost-effective coverage of your medications.

6. Consider Your Expected Utilization

At this stage, you might still have a list of 15 plans in front of you. Ask yourself how much you think you’re going to be using the benefits of the plan over the course of the next year.

“If you’re healthy, then you probably want a high out-of-pocket maximum, a low copay and a high deductible, which means in the infrequent times you go [to the doctor], you pay a small amount but you’re really not going to have any catastrophic events where you’re going to hit your out-of-pocket maximum,” explains Rich. “Someone who is sicker might have a different scenario where they would want a higher monthly premium but a reduced out-of-pocket maximum so that when they go to the doctor frequently, after that out-of-pocket maximum is hit, the plan covers them 100%.”

7. Browse Additional Coverage

If you still find yourself staring at a few plans, compare them based on other health care needs you want to prioritize, such as dental, vision, hearing, over-the-counter or transportation coverage. This final criteria should help you identify the 2022 plan best suited to your current needs.

Working With Insurance Agents

If the guide above still incites a wave of panic or you just don’t want to wade through these waters alone, you can seek additional assistance from an insurance agent or advisor. But know that not all agents are the same.

Some agents, often referred to as independent or agnostic agents, have access to all available plans in your area, are licensed to sell all of those plans and receive the same commission no matter which plan you choose. It is their job to sell you health insurance coverage, and they do benefit from that sale, but because every sale carries equal weight for their bottom line, they are more likely to approach the plan selection process with your best interests in mind.

Other agents might only have relationships with specific carriers or receive higher sales commissions from those carriers when they sell certain plans. If you choose to work with one of these agents, be aware of these limitations and inherent biases.

To find an advisor or agent in your area who can show you all plans relevant to you and help you make your selection, search a phrase like “independent Medicare advisors” and carefully review the options that appear. You can also look for the phrase “first-tier, downstream related or entity” (FDR), says Rich. Such organizations operate under significant oversight, are regulated with audits and phone call recordings, and prioritize keeping your personal information private, he says.

Meanwhile, many seniors already work with what the industry calls a “kitchen table agent,” an individual they trust to come into their home—often literally—with a handful of plans to simplify the shopping process. If maintaining this existing relationship is important to you, consider asking your agent the following questions:

- How many plans do you search across?

- How do you conduct that search?

- Are you licensed and appointed with each of those plans?

- What are your security procedures for protecting my Medicare beneficiary ID and list of doctors and prescriptions?

Based on their answers, you can better determine how that agent is serving you in your plan selection process and protecting your private information.

Beware of Medicare Scams

As if navigating the noise of third party marketing and sliding past sketchy agents isn’t enough work, there’s also serious Medicare fraud to be aware of. From misleading direct mailers to pushy phone calls to social security identity theft, seniors are taken advantage of every day.

Want to avoid Medicare scams entirely? There are a few simple steps you can take:

- Protect your private personal information by storing ID cards, medical data and more in a secure place.

- Don’t answer calls from phone numbers you don’t recognize. (If it’s an important call, they’ll leave you a voicemail. Since spammers can leave voicemails, too, only return the calls of people you know.)

- Question all Medicare-related materials received to either your mailbox or inbox (with the exception of the guide you receive from CMS).

- When in doubt, do your research. Talk to independent sources and let their expertise give you peace of mind.

Sources

A Snapshot of Sources of Coverage Among Medicare Beneficiaries in 2018. Kaiser Family Foundation. Accessed 10/25/2021.

A Dozen Facts About Medicare Advantage in 2020. Kaiser Family Foundation. Accessed 10/25/2021.

Memo Signals Biden Admin Will Keep Close Eye On MA Marketing Actions. Inside Health Policy. Accessed 10/25/2021.

Insulin. Medicare.gov. Accessed 10/25/2021.

The Impact of the COVID-19 Pandemic on Medicare Beneficiary Utilization and Provider Payments: Fee-For-Service (FFS) Data for 2020. ASPE Office of Health Policy. Accessed 10/25/2021.

Health insurance rights & protections: Rate Review & the 80/20 Rule. HealthCare.gov. Accessed 10/25/2021.

How to Identify First Tier, Downstream, and Related Entities (FDRs). Provider Trust. Accessed 10/25/2021.

Agent Commissions in Medicare and the Impact on Beneficiary Choice. The Commonwealth Fund. Accessed 10/25/2021.